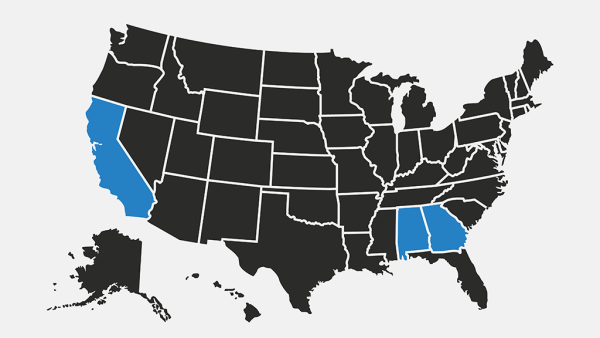

The Internal Revenue Service recently extended tax relief for disaster victims in Alabama, California, and Georgia. Individuals and businesses in these federally declared disaster areas now have until October 16, 2023, to meet several filing and payment deadlines.

Which filing and payment deadlines are extended by this tax relief?

The tax relief provided to disaster victims in Alabama, California, and Georgia affects a number of deadlines, including:

- January 17: fourth quarter 2022 estimated tax payments

- January 31: quarterly payroll and excise tax returns

- March 1: farmer returns for those who forgo estimated tax payments

- March 15: various business returns

- April 18: individual income tax returns

- April 18: various business returns

- April 18: estimated tax payments

- April 30: quarterly payroll and excise tax returns

- May 15: tax-exempt organization returns

- June 15: estimated tax payments

- July 31: quarterly payroll and excise tax returns

- September 15: estimated tax payments

Additionally, uninsured and unreimbursed losses resulting from these disasters can be “[claimed] on either the return for the year the loss occurred or the return for the prior year.”

Can anyone else qualify for this tax relief?

Taxpayers living outside disaster areas can also receive this tax relief if they meet specific requirements, like storing deadline-relevant records or serving as relief workers for a “recognized government or philanthropic organization” in those locations. The IRS directs these individuals to call 866-562-5227 to learn more about potentially qualifying.

Where can I learn more about this tax relief?

The following resources contain more information about affected deadlines and claiming uninsured or unreimbursed losses, respectively:

- Disaster Assistance and Emergency Relief for Individuals and Businesses

- Publication 547, Casualties, Disasters, and Thefts

If you’re interested in earning CPE while learning to serve clients affected by a disaster, check out our new Federally Declared Disasters course on DrakeCPE.com. This course will teach you to determine filer eligibility, identify casualty losses, and prove, figure, and report gains and losses.

Source: IR-2023-33